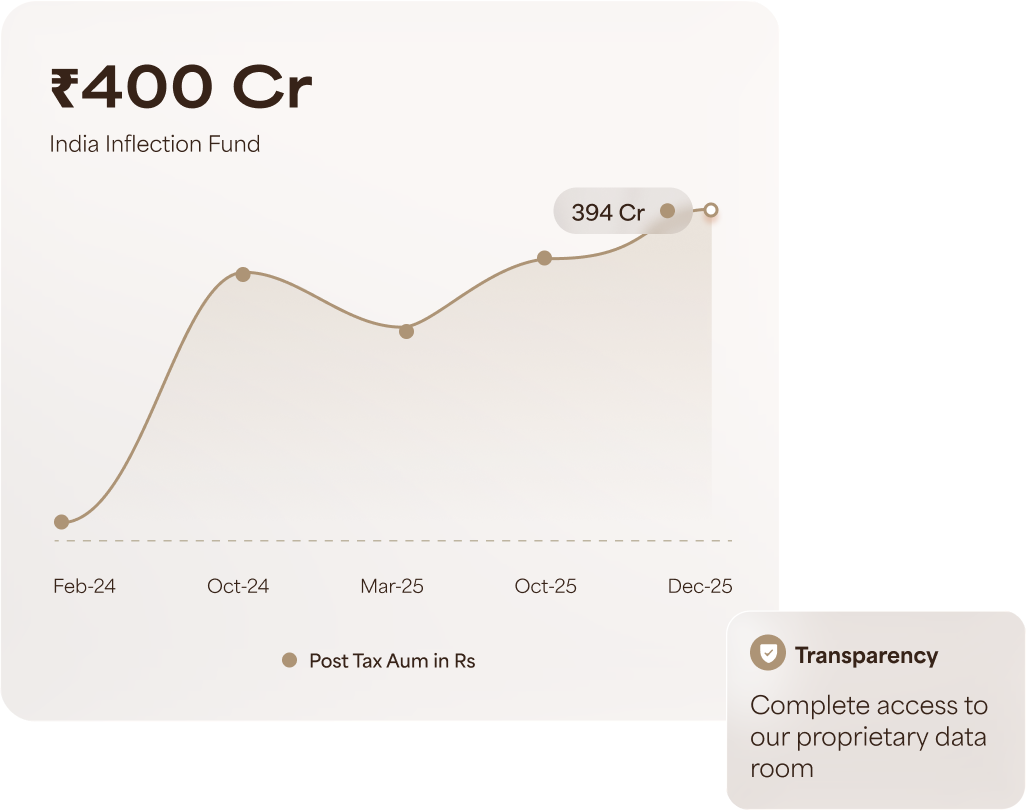

400 CR+

AUM Built on Trust, Not Distribution

Assets under management (AUM) of ₹400 crore (since Feb 2024) — built entirely on investor trust, without any distributor involvement.

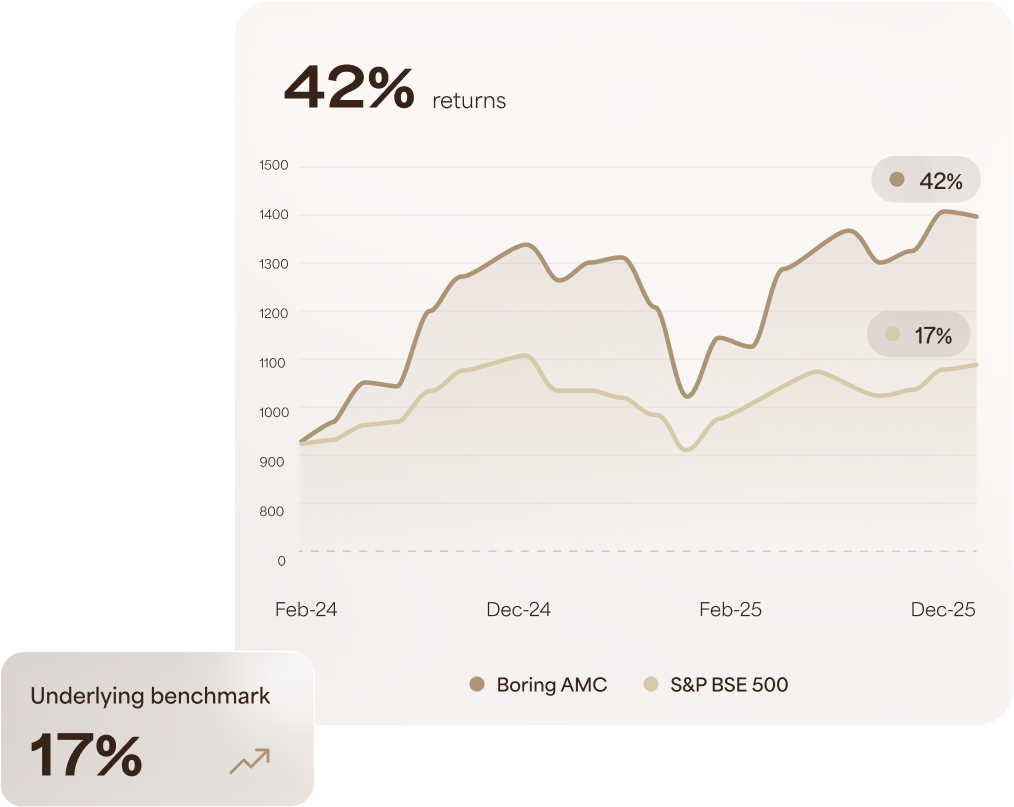

42%

Catching the Cycle Ahead of Markets

Delivered gross returns (pre-tax) of 42% as of Feb 2026, compared to 14% for the underlying benchmark — driven by identifying market cycles early.

100 years

Experienced Team

A highly experienced team with a cumulative market experience of nearly 100 years, combining deep research expertise and long-term investing discipline.

Manage Risk

Robust Risk Management

Follows a strict stock and sector allocation framework to manage risk. The team stays unmoved by market noise, remaining focused on valuations and fundamentals to stay ahead of the curve.

Why Boring AMC?

Boring AMC builds wealth through disciplined investing, early-cycle identification, and valuation prudence—backed by an experienced team, strong risk management, and a proven track record of capturing India's structural growth stories.