Why India

- Did you know?

- The Big Picture

- What has change in India

- India in News

Did You Know

Some Powerful Facts About India

01

Global economic leap

India is now the 4th largest economy in the world, up from 10th place around a decade ago. By 2030, India is widely expected to become the 3rd largest economy, overtaking Japan.

02

Extraordinary long-term GDP compounding

India’s GDP expanded from ~US$275 billion in 1991 to nearly US$4 trillion by March 2025, implying a ~8%+ CAGR in dollar terms over 34 years—one of the strongest sustained growth records globally.

03

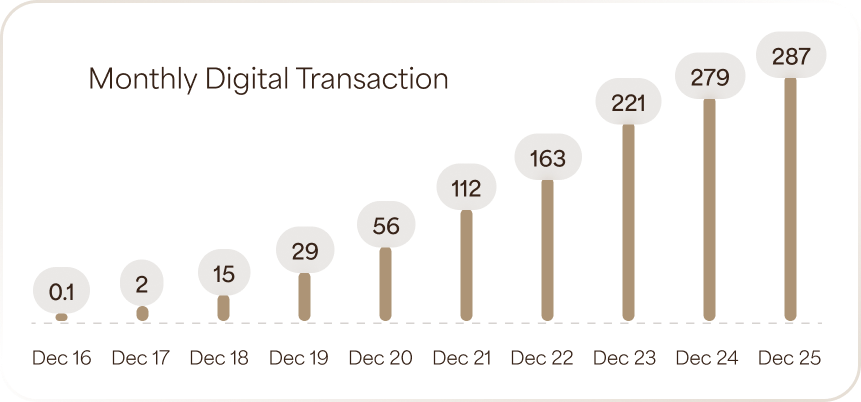

Digitalisation at population scale

With 900+ million internet users and among the lowest data costs globally, India has witnessed a ~140× increase in digital transactions over the past eight years, driven largely by UPI.

04

Financial inclusion revolution

Bank account penetration now exceeds 90%, compared with ~35% in 2011, marking one of the fastest financial inclusion expansions ever recorded.

05

Unprecedented infrastructure build-out

India’s physical and social infrastructure additions during FY15–FY30 are expected to exceed the cumulative capacity added over the prior ~65 years, spanning roads, railways, power, housing, digital and social infrastructure.

06

Household savings backbone

Indian households contribute over 60% of the country’s gross savings pool, providing long-term stability and funding capacity for domestic investment.

07

External balance improvement

India’s current account position has structurally improved, with the economy increasingly capable of operating near balance—and potentially moving toward periodic surplus phases over the medium term as exports and services scale up.

08

Discretionary consumption inflection

As India approaches ~US$5,000 per-capita income by 2030, discretionary consumption is expected to rise to ~43% of total consumption, up from ~36% currently, unlocking powerful demand tailwinds.

09

Formalisation dividend

Structural reforms such as GST, UPI, and e-invoicing are accelerating formalisation, broadening the tax base, improving compliance, and creating durable scale advantages for organised players across sectors.

India - THE BIG picture

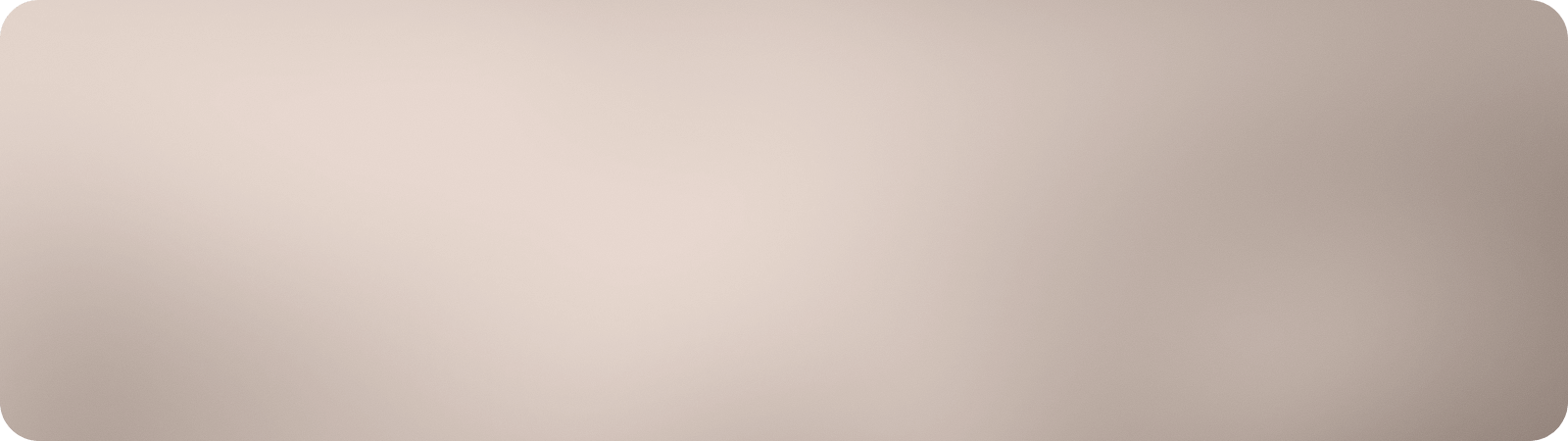

Indian GDP is set to accelerate from $4Tn to $25Tn in the next 2.5 decades

India Nominal GDP Projections with Values (USD Trillions) - 2025 - 2050

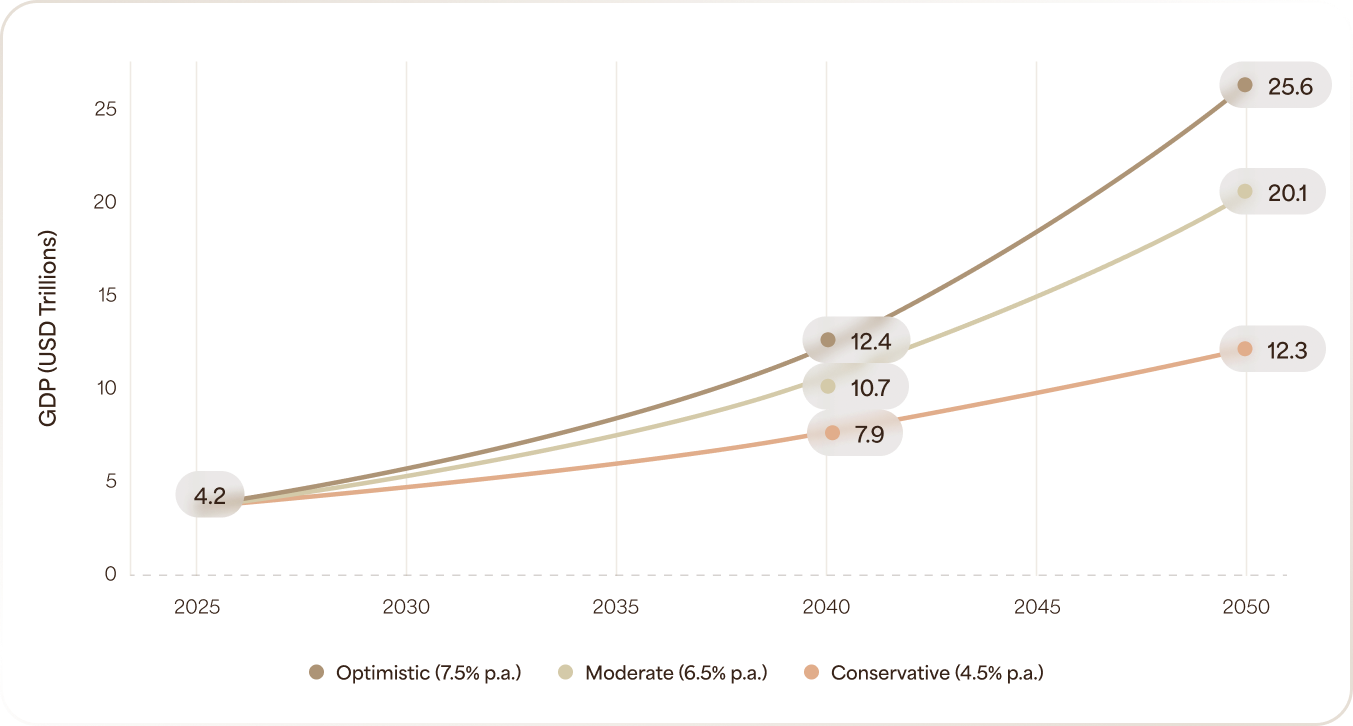

Rising share of manufacturing in the economy

India: Manufacturing Sector share of GDP (%)

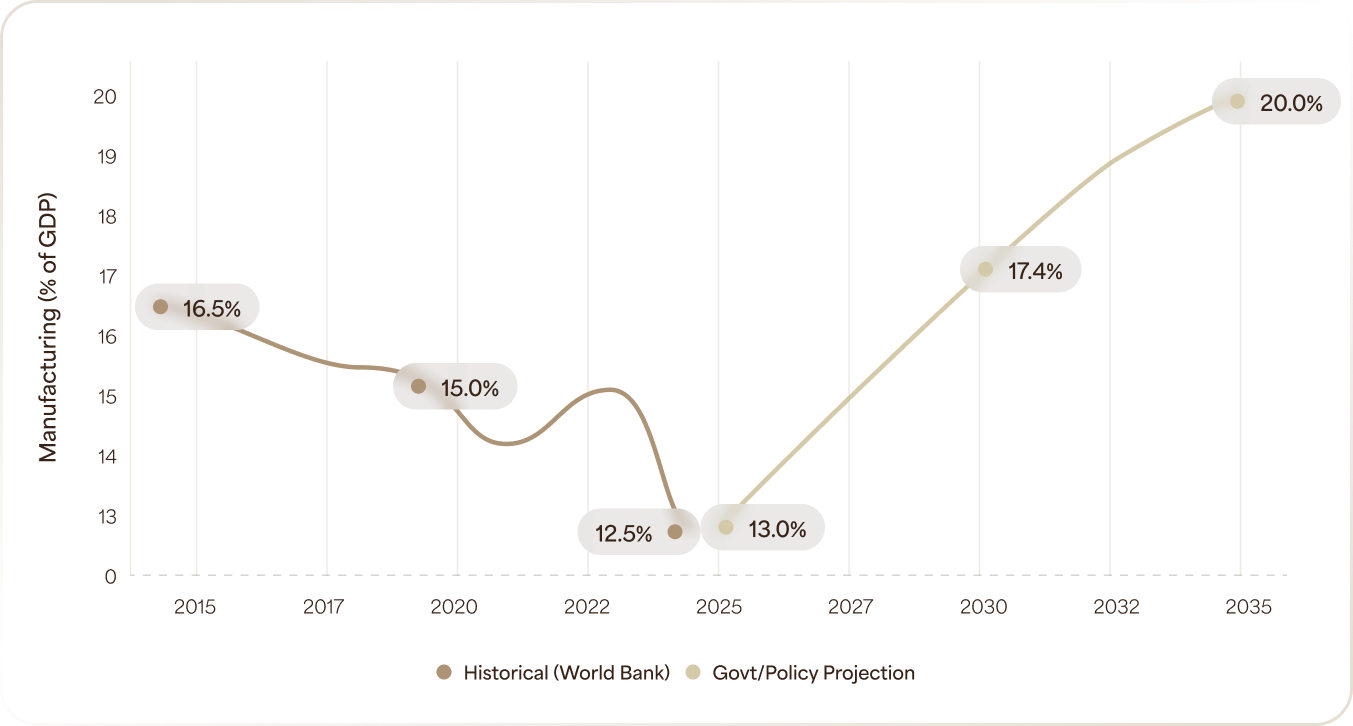

Rising importance of financials

India: Banking & Insurance -Share of GVA (%) (Estimated History & Projection)

What Has Changed In India?

A Decade of Structural reforms

Laying the foundation for a more formal, productive, and scalable economy

Pre - 2014

-

Fragmented taxation

-

Cash-led transactions

-

Informal businesses

-

Weak insolvency framework

-

Infrastructure bottlenecks

Reform Stack

- Demand & Liquidity Transmission Income tax relief | GST slab rationalisation | Lower interest rates

- Formalisation GST & Insolvency & Bankruptcy Code

- Digital Public Infrastructure Aadhaar | UPI | Account Aggregators

- Financial Inclusion Jan Dhan | Direct Benefit Transfers

- Manufacturing Push PLI Schemes | Supply Chain Integration

- Infrastructure Capex Roads | Rail | Ports | Power

- Ease of Doing Business Faster Approvals | Tax Reforms

Today

-

Formal and transparent economy

-

Digital payments at scale

-

Faster capital recycling

-

Manufacturing depth improving

-

Infrastructure as growth backbone

- Higher productivity - Better capital allocation

- Improved demand transmission

- Lower systemic risk

India’s Balance Sheet has strengthened

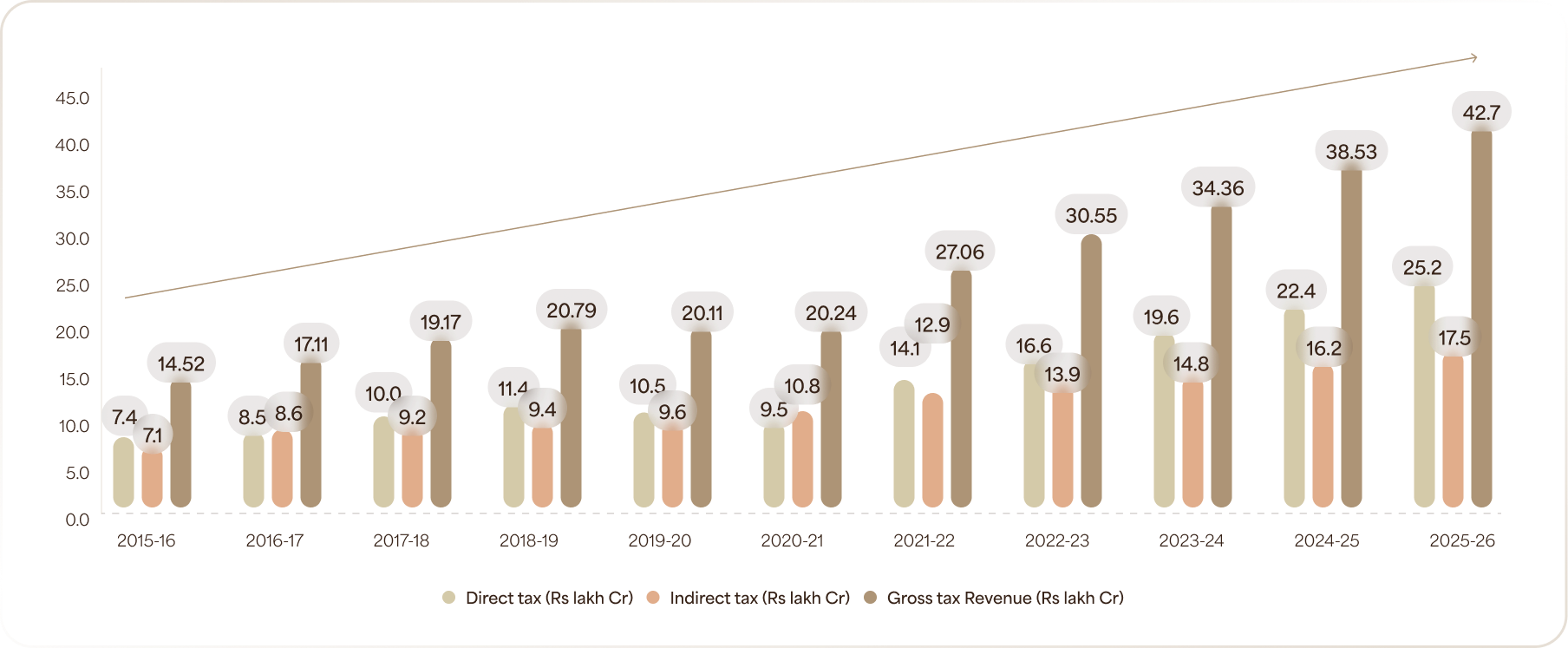

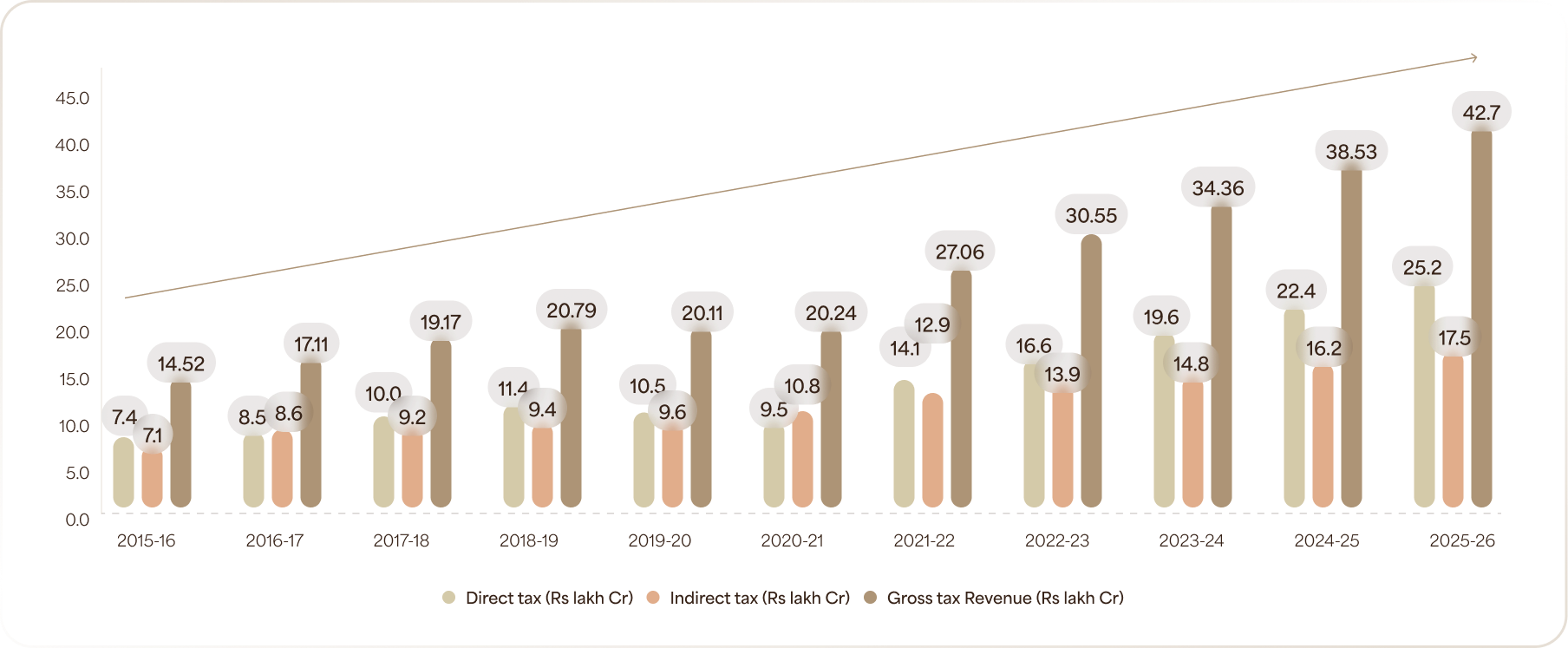

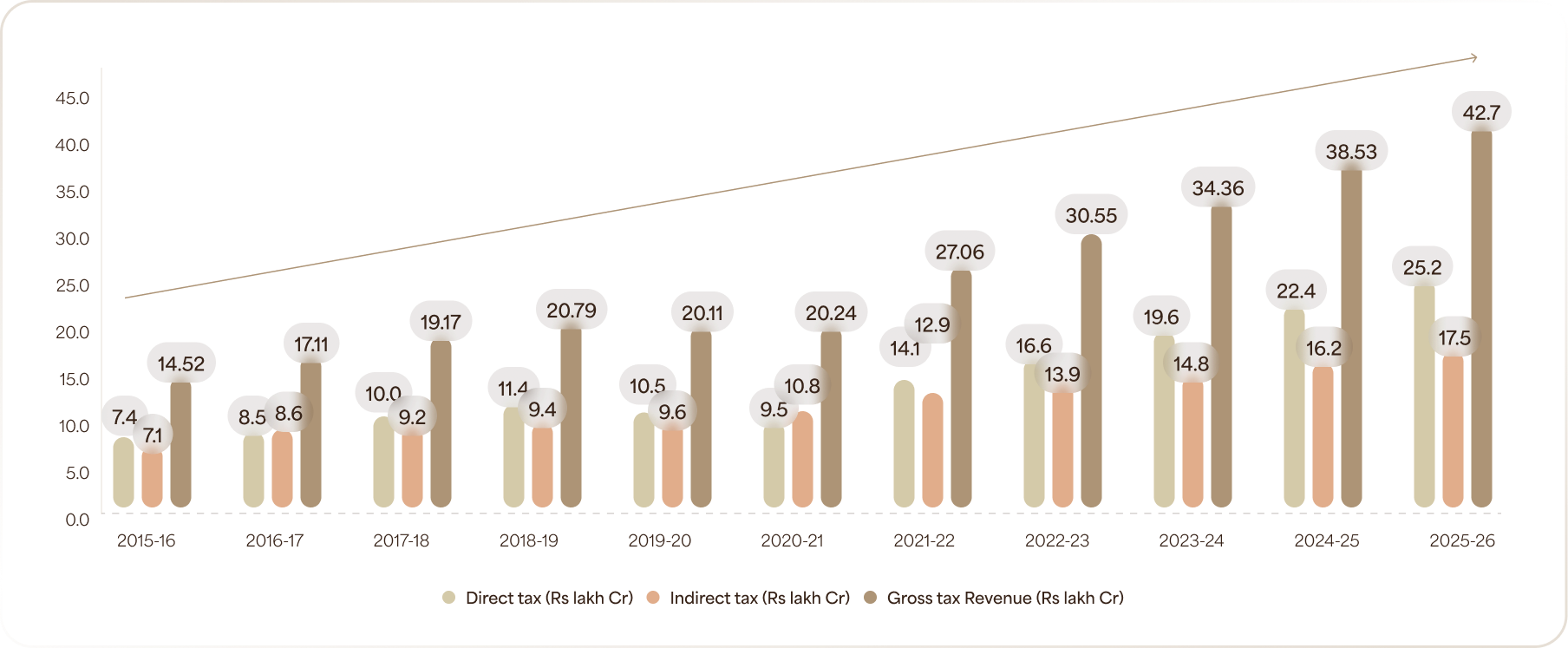

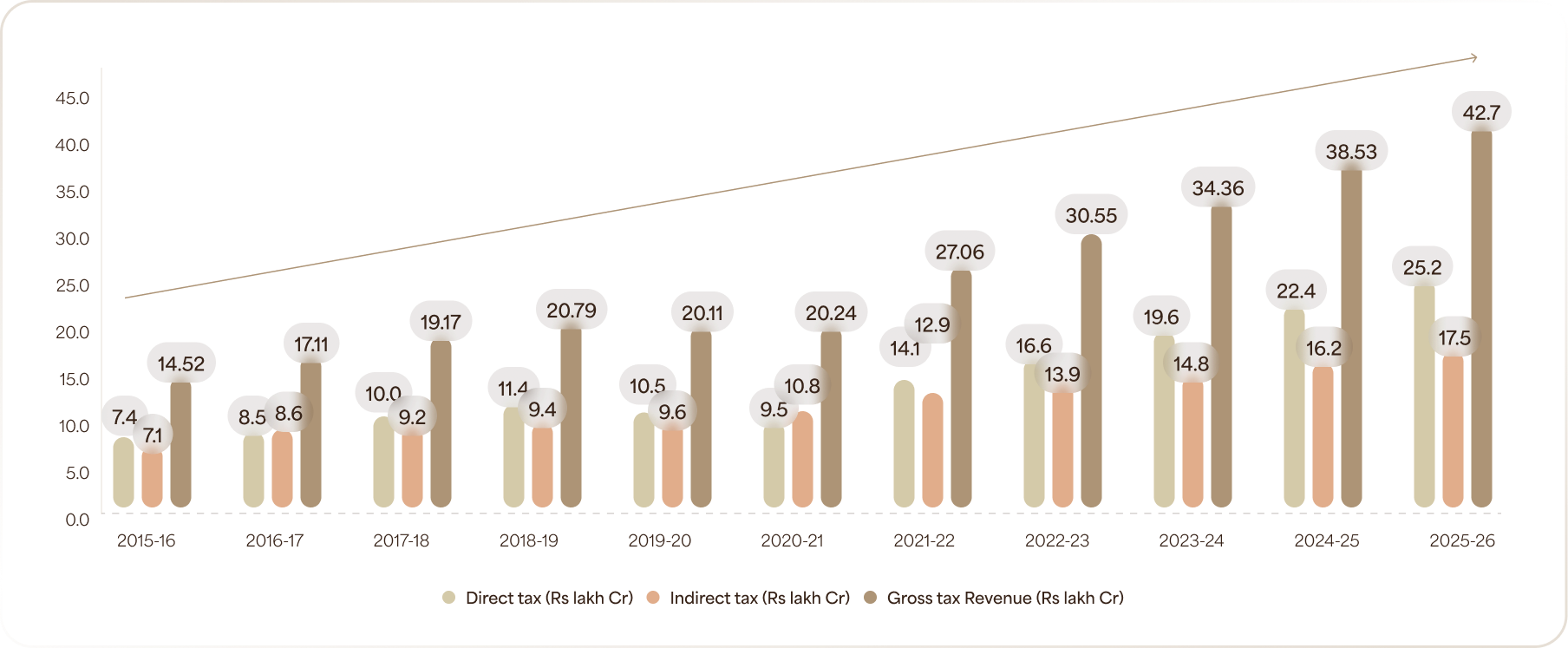

Tax Receipt Growth - leakages have stopped which is leading to formalization of economy

3x Tax Growth in 10 years

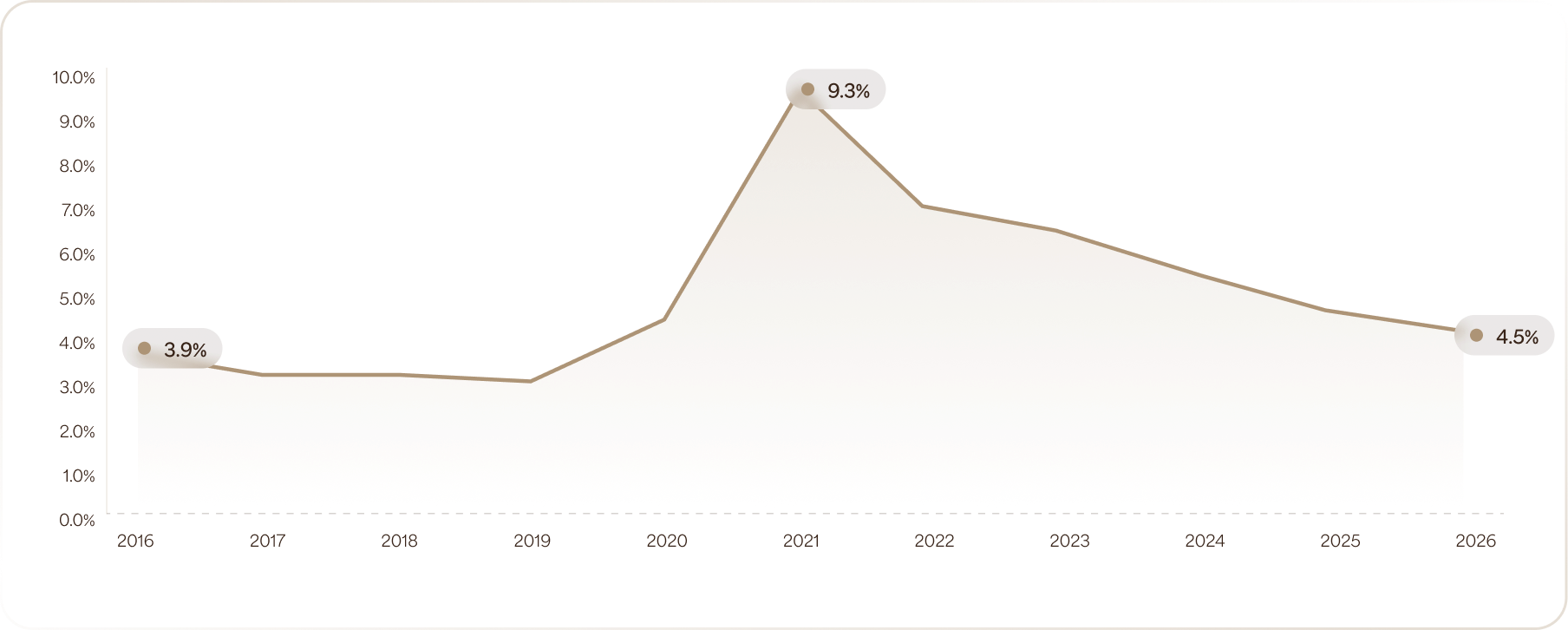

Balancing growth and fiscal prudence

Fiscal Deficit (%of GDP)

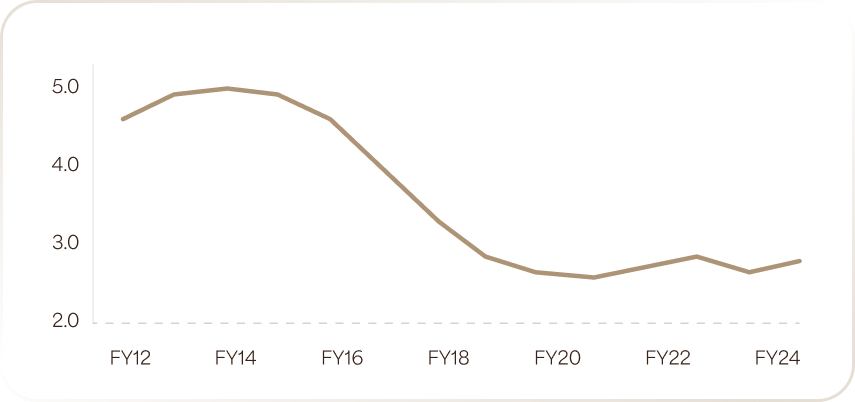

Since 2008: GDP - 4x, Oil Import Bill 80%

Moving 5Y avg net Oil imports as % of GDP

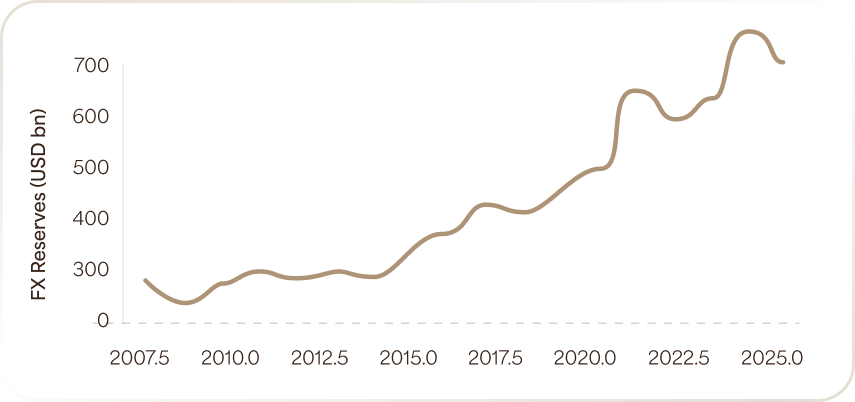

Forex Reserves rising – Investor confidence follows

India FX Reserves (2008-2025)

Credit Cycle Upside

Banks have clean balance sheets and corporates have low debt. This "double-engine" suggests that credit growth in India could stay in the $12-$15 range for several years.

NSE 500 Total Debt/Equity

Indian Banks NPA: Improving Health

Digital India

Initiatives of Indian government for mass-scale use cases on Digital India

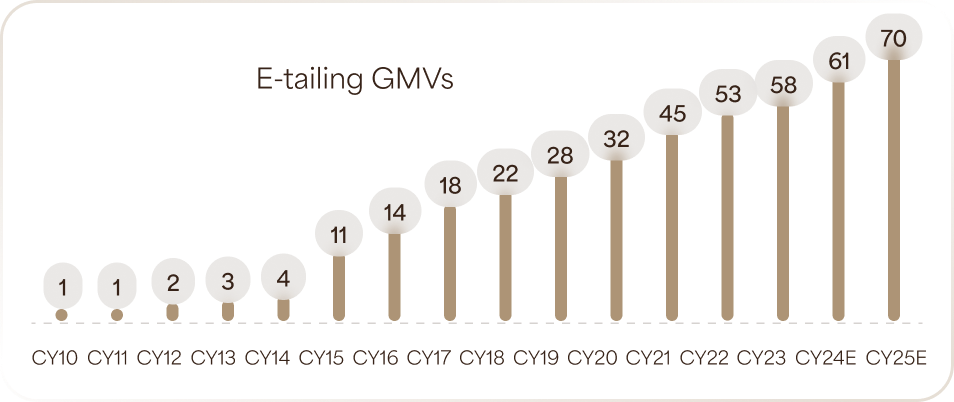

Ripple Effects of digital India in the E-Commerce space

Digitization boosting e-commerce

Digital transactions multifold

Digital India’s Impact

Increasing transparency, reducing costs and compliance

0-1.2 Bn

-100% coverage among adults

$23 to $0.5

per verification

0-7.5 Bn

Issued documents

0-1.2 Bn

-100% coverage among adults

0-240 Mn

Monthly bills paid

0 - $10 Bn

Value of loans

Tax Formalization

4M - 14M

Tax paying Businesses

Physical Infra

0-4B

Digitally paid toll per annum

India in the news

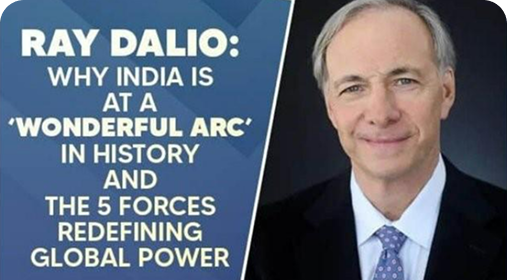

In a major boost towards attaining Viksit Bharat, billionaire investor Ray Dalio opined that India is favorably placed as the world enters a period in which several powerful historical forces are colliding at once, a convergence that typically marks the end of one global order and the birth of another. he highlighted that India has emerged with the strongest set of “ingredients” for sustained growth over the next decade.

The Financial Express

Ray Dalio: Why India is at a “Wonderful Arc” in history and the 5 forces redefining global power

In its latest Global Economic Prospects report, the World Bank said India's resilience helped lift overall growth in South Asia in 2025, offsetting the impact of heightened policy uncertainty and global trade frictions. India's economy is projected to remain among the world's fastest-growing major economies, with growth estimated at 7.2 per cent in FY2025-26.

NDTV

World bank Projects India’s growth at 7.2% due to “Resilient Activity”.

India's banking sector has achieved a multi-decade milestone with bad loans falling to a low of 2.1%. The RBI's latest report highlights strong balance sheets, double-digit credit growth, and resilient NBFCs. PM Modi's commitment to financial stability and ease of doing business continues to drive nationwide economic expansion.

The Economic Times

India’s bank on firm footing as bad loans decline to decades - low of 2.1%, says RBI

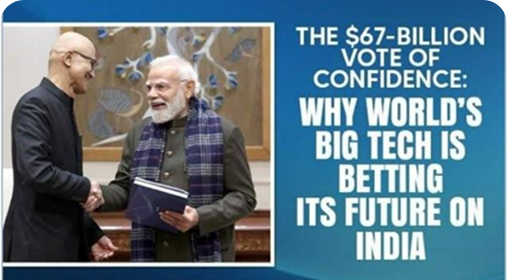

"Put your money where your mouth is." It is an adage. It simply means this: show by actions and not just words that you support or believe in something. For long, the world's top CEOs have expressed confidence in India's growth prospects. Unlike anytime in its history, India is now being scoped out by Amazon, Microsoft, and Google, who have in the past few weeks collectively committed over $67 billion.

News18

The $67-Billion Vote Of Confidence: Why World's Big Tech Is Betting Its Future On India

E-commerce giant Amazon has announced plans to invest more than $35 billion across all its businesses in India through 2030, seeking to expand exports, create jobs and invest in artificial intelligence. "The investment will create one million jobs, boost cumulative exports to $80 billion, and deliver Al benefits to 15 million small businesses", the e-commerce company statement added.

The Economic Times

Amazon says will invest $35 billion in India by 2030, investment will create one million jobs

Mobile phone imports in the country have become almost negligible at around 0.02 per cent of domestic demand in 2024-25 from 75 per cent 10 years ago, according to data shared in Parliament on Friday. Minister of State for electronics and IT Jitin Prasada, in a written reply to the Rajya Sabha, shared that production of electronic goods has increased 6 times to Rs 11.3 lakh crore in 2024-25 from 1.9 lakh crore in 2014-15, following measures taken by the government.

The Economic Times

Mobile phone import drops to 0.0% of local demand in 2024-25 from 75% in 2014-15

For the first time since 2021, when Apple started production in India, its iPhone exports from the country crossed Rs 2 trillion in 2025. Its exports in January-December 2025, according to data provided, reached a record $23 billion, up nearly 85% over the corresponding 12 months of 2024. Apple's main focus under the PLI scheme in India till 2024 had remained expanding the exports of iPhones.

Business Standard

India's iPhone exports hit 2 trillion in CY25, a first since 2021

India's electronics exports crossed the Rs 4 lakh crore mark in 2025 and are expected to grow further as four semiconductor manufacturing plants begin commercial production this year, Union Electronics and IT Minister Ashwini Vaishnaw said. According to official estimates, electronics production stood at around Rs 11.3 lakh crore in 2024-25, while exports were valued at about Rs 3.3 lakh crore.

The Economic Times

India's electronics exports hit Rs 4 lakh crore in 2025: IT Minister Vaishnaw

Bosch says India is emerging as a global Al development hub for its tech innovations, especially in smart mobility and industrial manufacturing, supported by over 20,000 Bosch software developers in the country. The German firm, which has committed $2.9 bn in Al innovation globally, sees India as a major growth and software hub, with increasing responsibility for global development.

The Economic Times

India emerging as a key development base for AI innovations, says Bosch

The next 20-25 years will be the era of India, which over the next decade or more is going to grow at 8-10 per cent, BlackRock CEO Larry Fink said. India, he said, has less need for the importation of capital. He went on to say that India over the next 10-plus years is going to grow from 8-10%. Praising the Modi government, he said digitised rupee has transformed commerce in the country.

The Economic Times

Next 20-25 years will be era of India, says BlackRock CEO Larry Fink

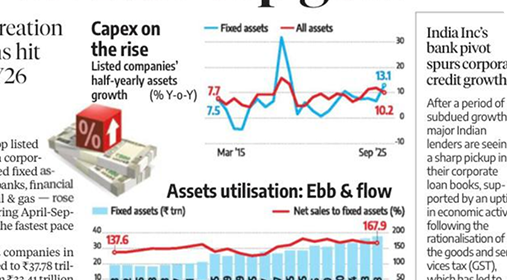

The half-yearly numbers of India's top listed companies point to a clear pick-up in corpor- ate capital expenditure. The combined fixed as- sets of listed companies -excluding banks, financial services and insurance (BFSI) and oil & gas - rose 13.1 per cent year-on-year (Y-o-Y) during April-Sep- tember 2025 (H1FY26), expanding at the fastest pace in six years.