India Inflection Fund

Control the risk.

Catch cycle early.

Stay away from noise.

Earnings over fancy stories.

Create wealth slowly.

Portfolio Construction

- Invested 100% in listed Indian equities

- 25-30 stocks to balance

- Conviction and diversification

- 5-10% position sizing to manage outcome risk

Risk Discipline

- Single-sector exposure capped at 20%

- No leverage

- No derivatives or structured products

Behavioral Edge

- Losses are cut when the thesis breaks

- Winners are allowed to compound

- Zero hero investing

Reason why we like manufacturing

Government focus after almost a decade

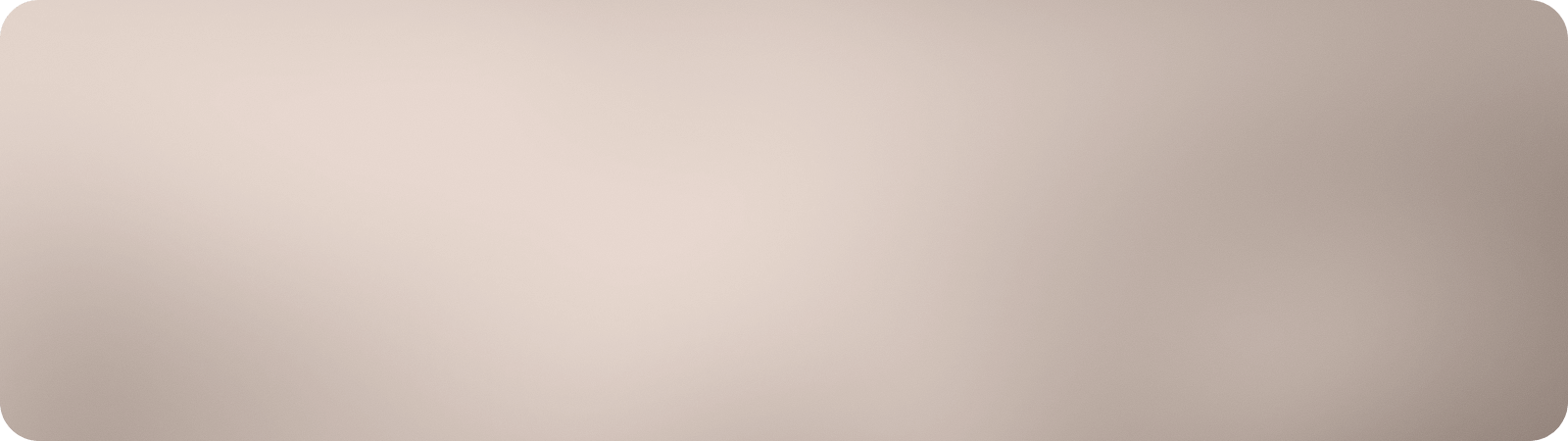

India Manufacturing Share: Current Level vs Government Targets (with Timelines)

Virtuous cycle of productivity growth, employment generation and income growth

Manufacturing Policy Support

Government shifts from “policy support” to pay-for-performance

Phase/Period

Key Government Action

What Changed Structurally

Manufacturing Outcome

2011-2014

National Manufacturing Policy (25% target announced)

Intent without execution capability

Stuck at~15-16% of GDP

2014-2019

Make in India, FDI liberalisation, Ease of Doing Business

Better investment climate but no output-linked incentives

Still~15-16% of GDP

2020-2023

PL schemes, China+1 shift, Gati Shakti infrastructure

Direct incentives for incremental production & exports

Manufacturing scale-up begins

2024-2025

NITI Aayog Manufacturing Roadmap (Technology-led growth)

Clear long-term roadmap to reach ~25% of GDP

Target ~25% of GDP by 2035

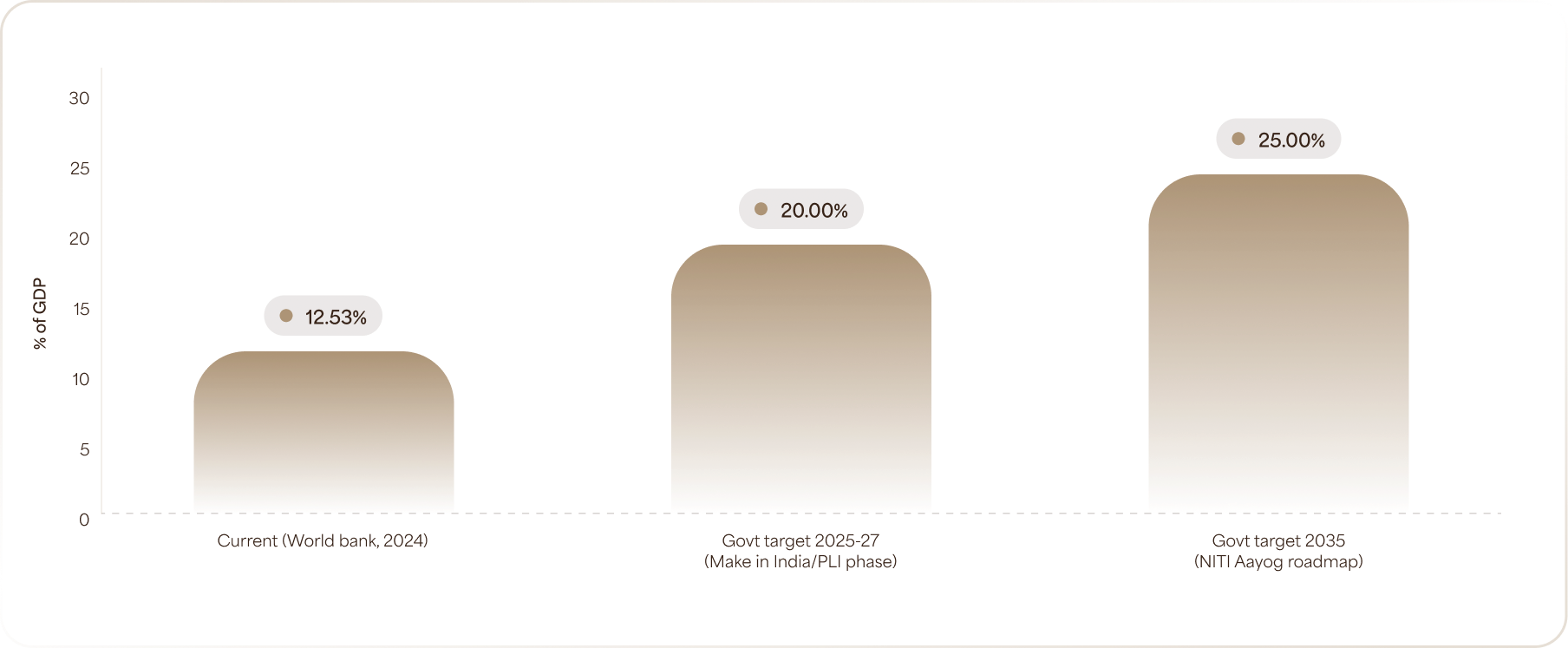

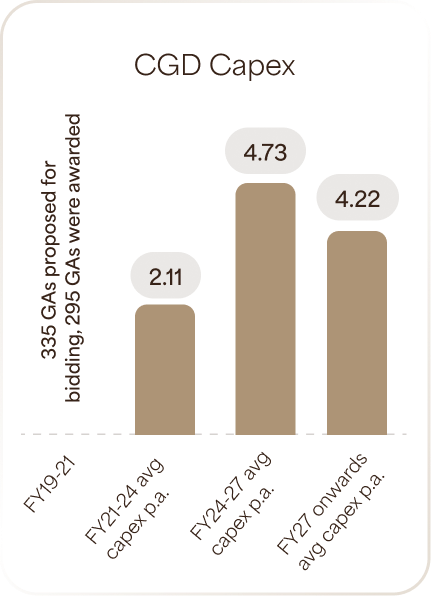

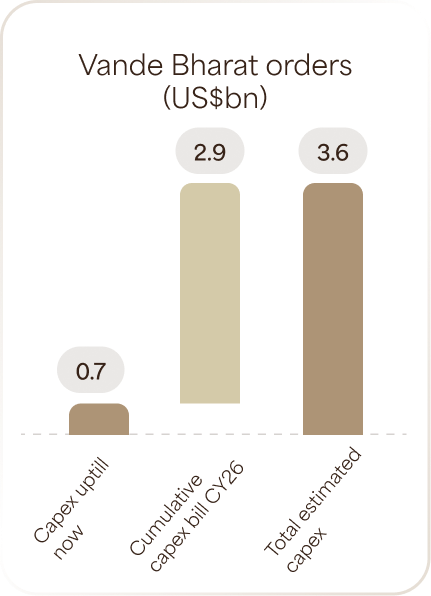

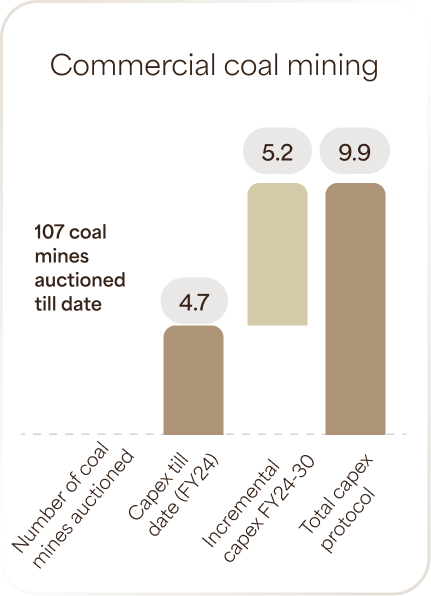

Opening monopolies in key sectors

We see similar theme playing out again as Govt is opening up monopolies in key sectors

Big changes in key sectors post govt focus - Import Substitution

The largest two-wheeler market globally (~23 million units annually)

The 3rd largest passenger vehicle market (~5-5.2 million units annually)

India is the 3rd-largest pharmaceutical producer in the world by volume

India is the world's largest supplier of generic medicines

The 3rd largest power generation capacity in the world

Sector

Import Dependency ~ 10 years ago (2014-16)

Current Exports / Output (2023-25)

Electronics & Smartphones

- Mobile phone Exports: ₹1,566 cr

- Heavy import Reliance

- Mobile phone Exports: ₹1.2 lakh cr

- Mobile Production: ₹5.45 lakh cr (FY 24-25)

Pharmaceuticals & APIs

- API Imports: ~₹13,853 cr (Largely from China)

- Pharma Exports: US$ 30.47 Billion

Solar & Renewable Manufacturing

- Solar Imports: US$ 2.34 Billion

- Solar Capacity: 120+ GW

- Solar Exports: US$ 344.5 Million (Qtr)

Auto, EVs & Auto Components

- Auto Exports: US$ 9.5 Billion

- Basic ICE Component Exports

- Auto Exports: 5.3 Million Units

- Auto Parts Exports: ₹1.95 Lakh Cr (US$ 22.9 Billion)

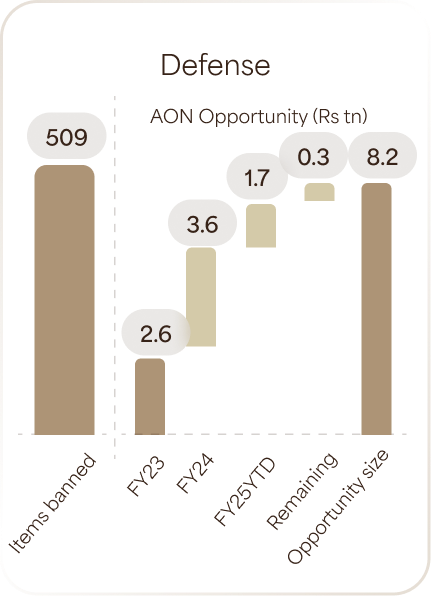

Defence Manufacturing

- Defence Exports: <1,000 cr

- High Import Dependence

- Defence Exports: ₹23,622 Crore

- Defence Production: ₹1.27 Lakh Cr

Chemicals & Specialty Chemicals

- Chemical Imports: US$ 15.9 Billion (Organic Chem.)

- Chemical Exports: US$ 34.6 Billion

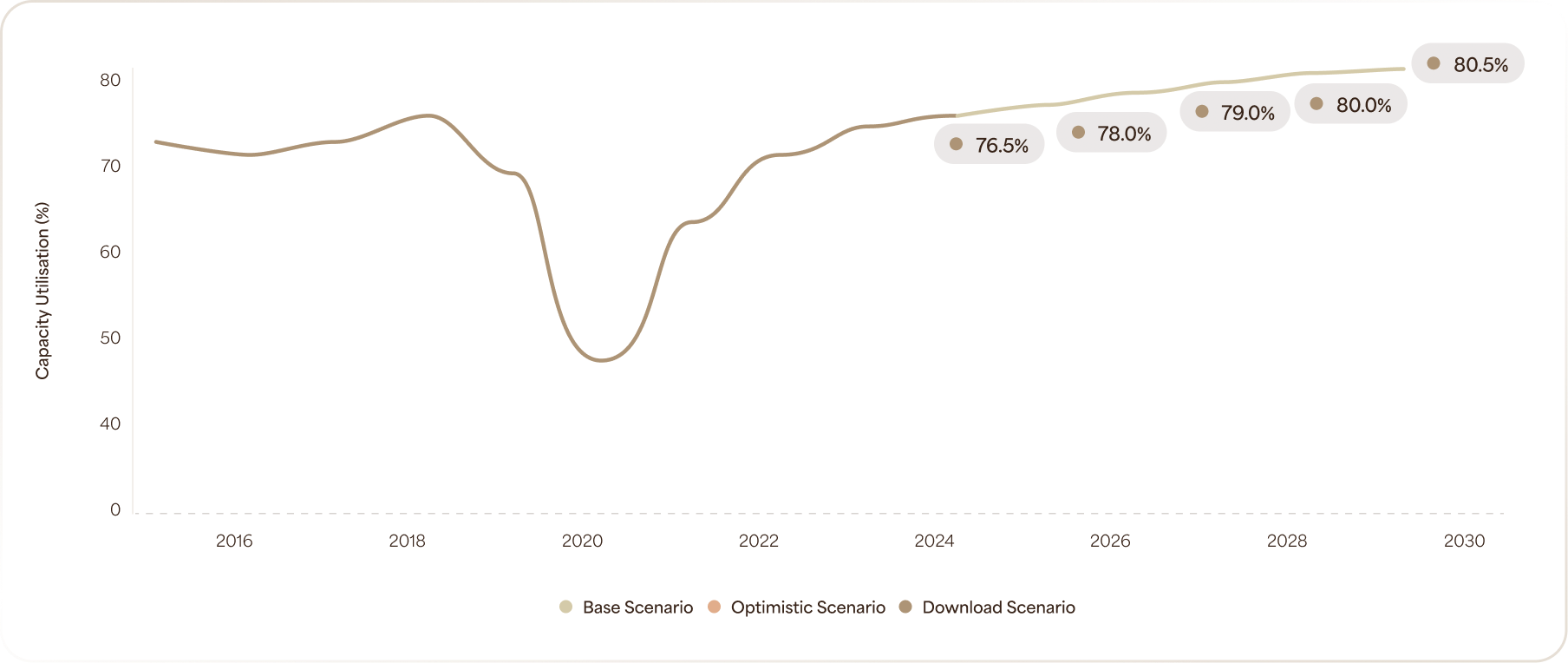

Capacity Utilisation Rising

Rising capacity utilisation is a case for another capex boom

Capacity Utilisation in India manufacturing: Historical (2015-24) and projections (2025-29)

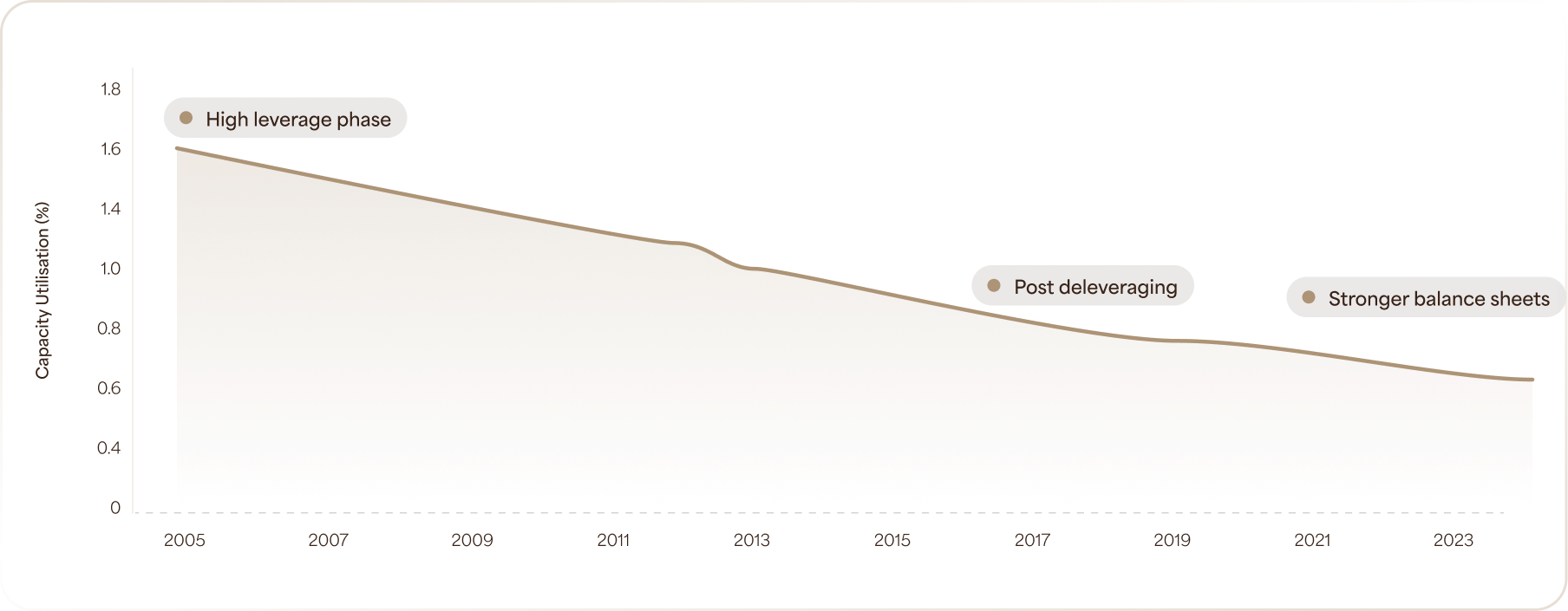

Deleveraged India

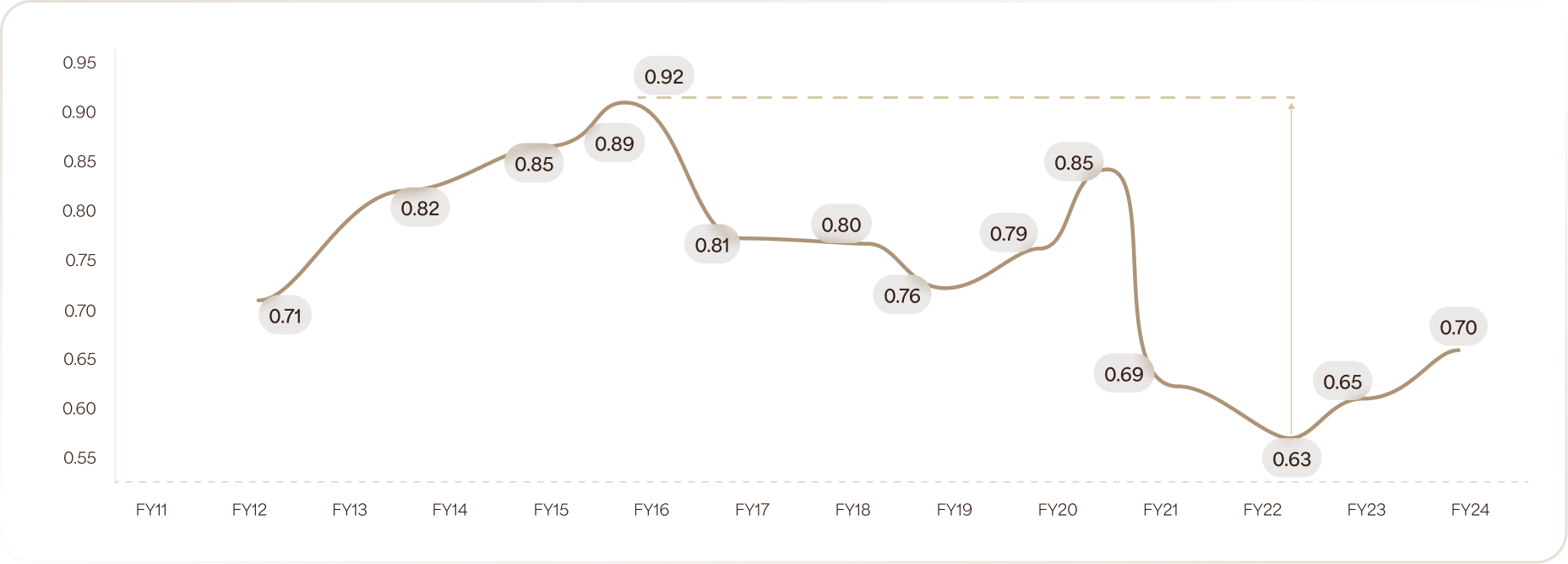

Manufacturing Sector D/E ratio trend

India Manufacturing Sector - Debt-toEquity ratio trend (2005-24) Aggrerate, RBI-based

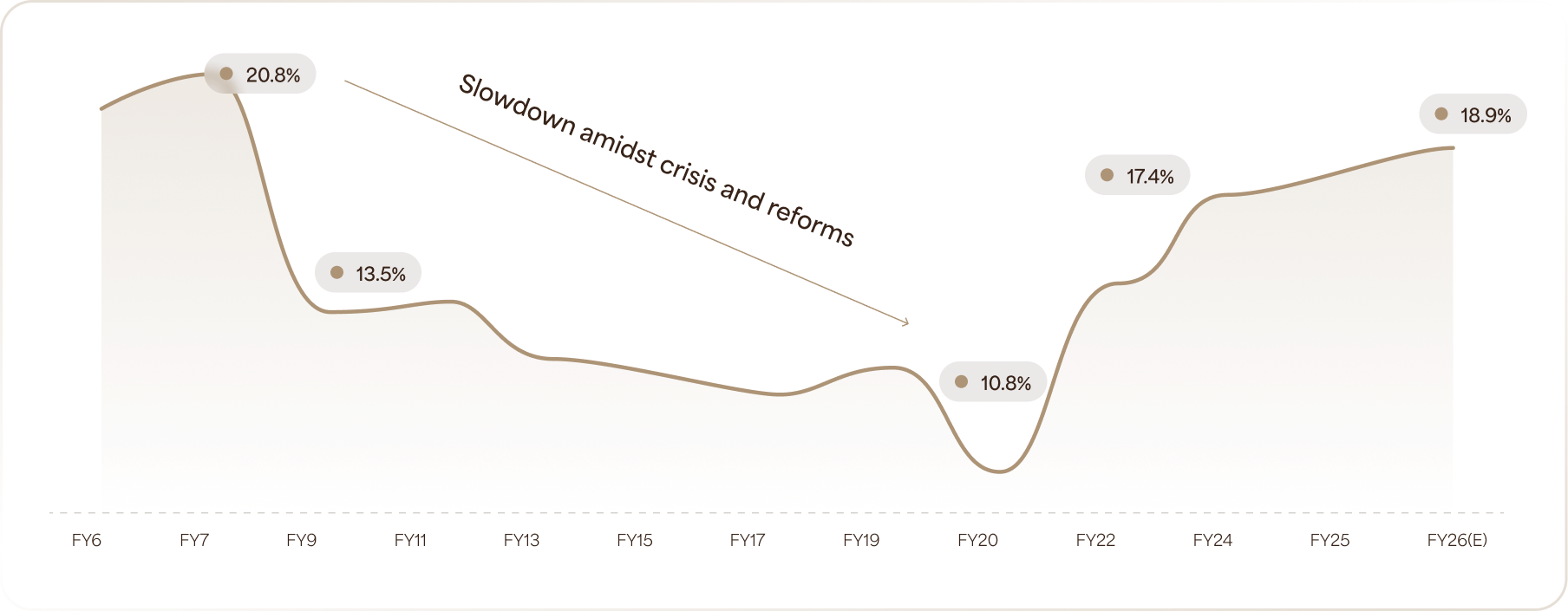

India’s Private Sector RoCE over 2 decades

India’s Private Sector Capital Allocation (RoCE)

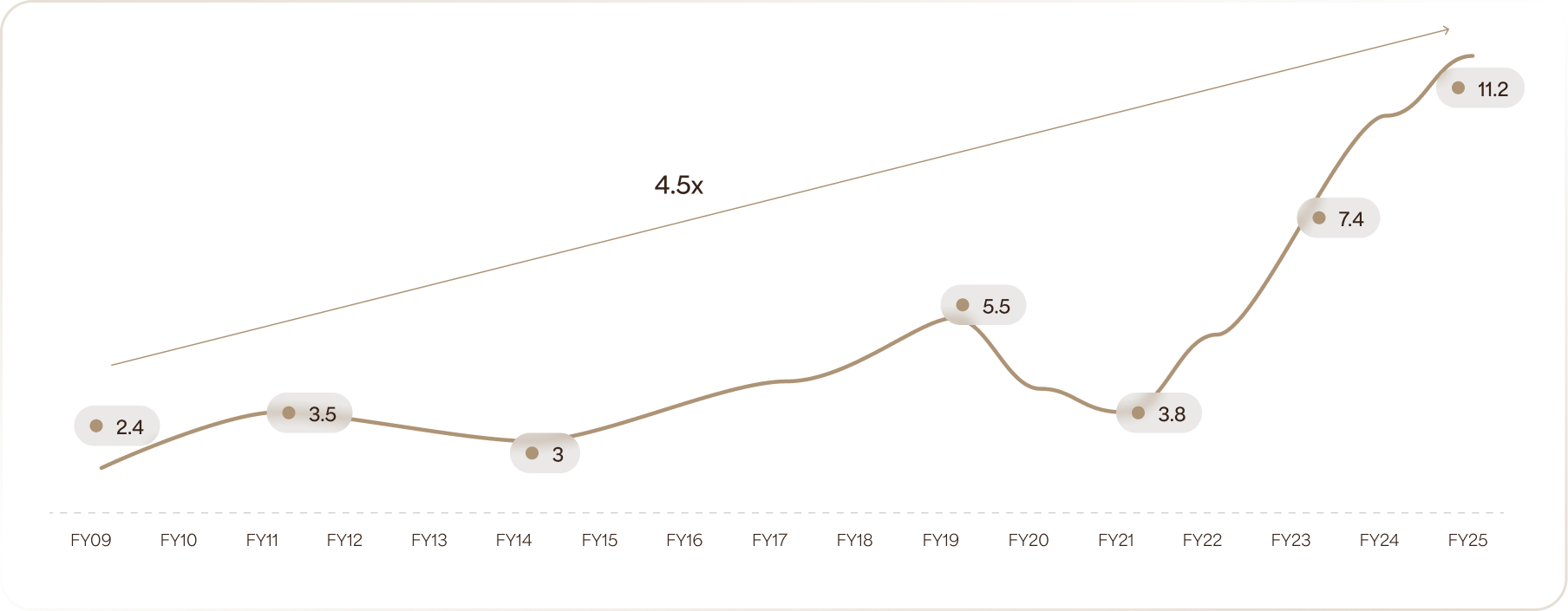

Average New Order Book Growth Per Company

Capability of order capture has risen for companies

Avg new orders per company (₹Bn)

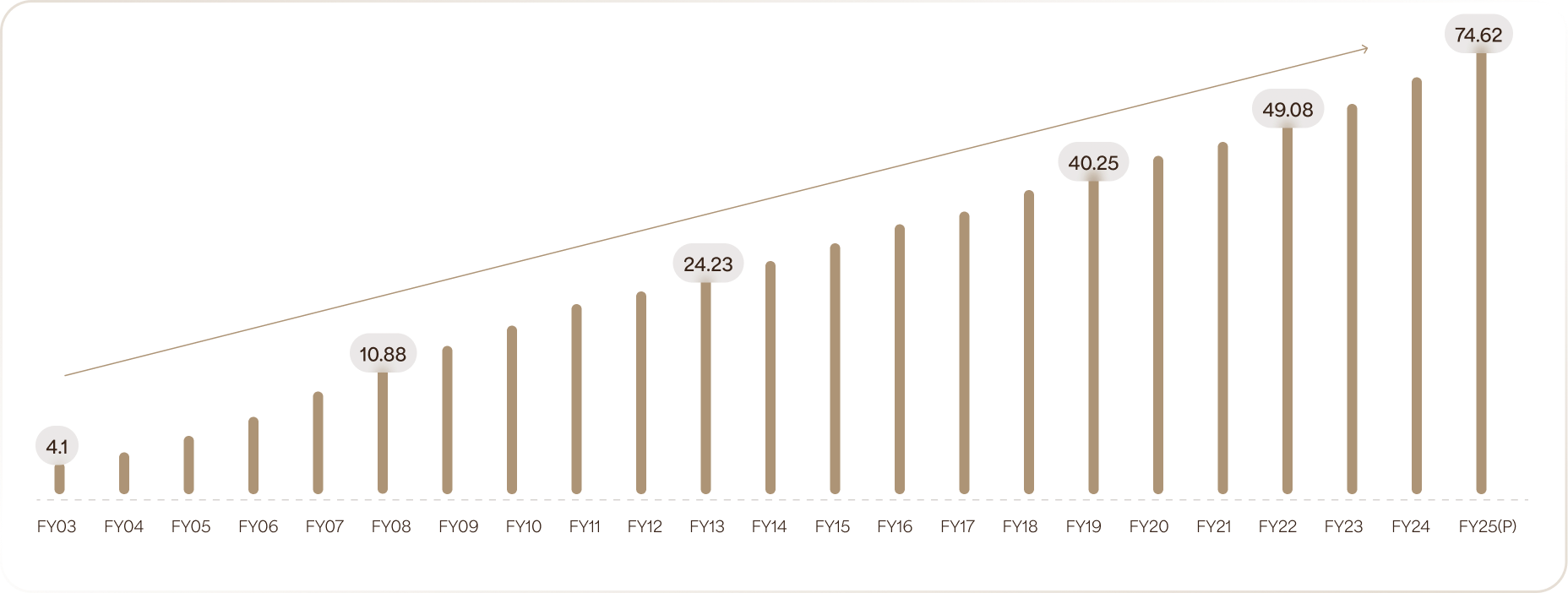

Gross Block Formation

Size of the companies has widened with reduction in leverage

BSE 500 Gross Block ( ₹ Lakh Crore)

Debt/Equity (x)

50% headroom for increasing leverage to fund capex

Deleveraged India Inc has enough headroom to increase leverage for funding capex. This sets the stage for a new leg of investment cycle.