Risk Management. Your edge

Disciplined investing, driven by deep research and risk management for sustainable wealth creation

At Boring Asset Management, our core focus is risk management, not the pursuit of outsized returns. We firmly believe that eliminating errors is the catalyst for achieving returns naturally. Our commitment is to compound wealth in a measured, responsible, and sustainable manner.

The India Inflection Fund, managed by Boring Asset Management, aims for long-term capital appreciation. It achieves this by focusing on investments in high-growth companies that are available at reasonable valuations. The strategy is to identify businesses early in their growth trajectory that show significant potential for capturing market share and delivering superior Returns on Capital Employed (RoCE).

Key investment criteria

Growth at Reasonable Valuation (G.A.R.V.)

Prioritize scalable businesses with long growth runways, but only at valuations that provide margin of safety.

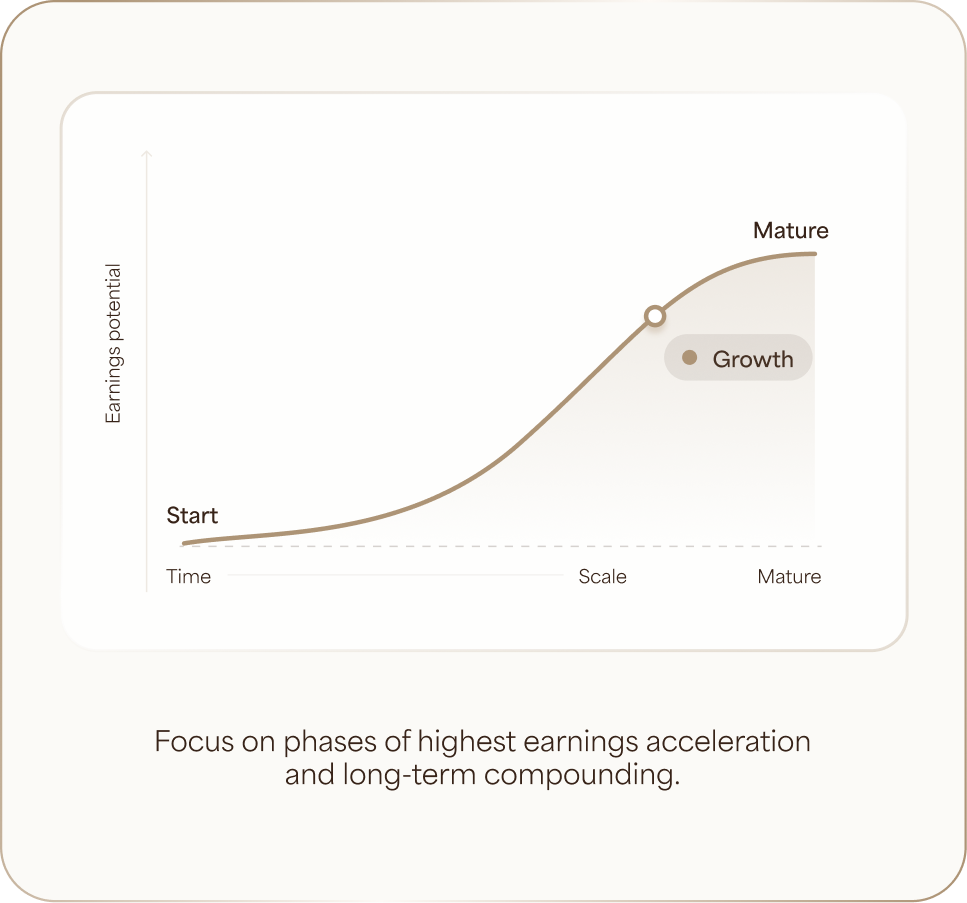

Early Cycle Investing

Enter companies in the early phases of expansion or capacity creation, where earnings compounding potential is highest.

Quality Bias

Focus on management integrity, prudent governance, and capital efficiency rather than short-term momentum.

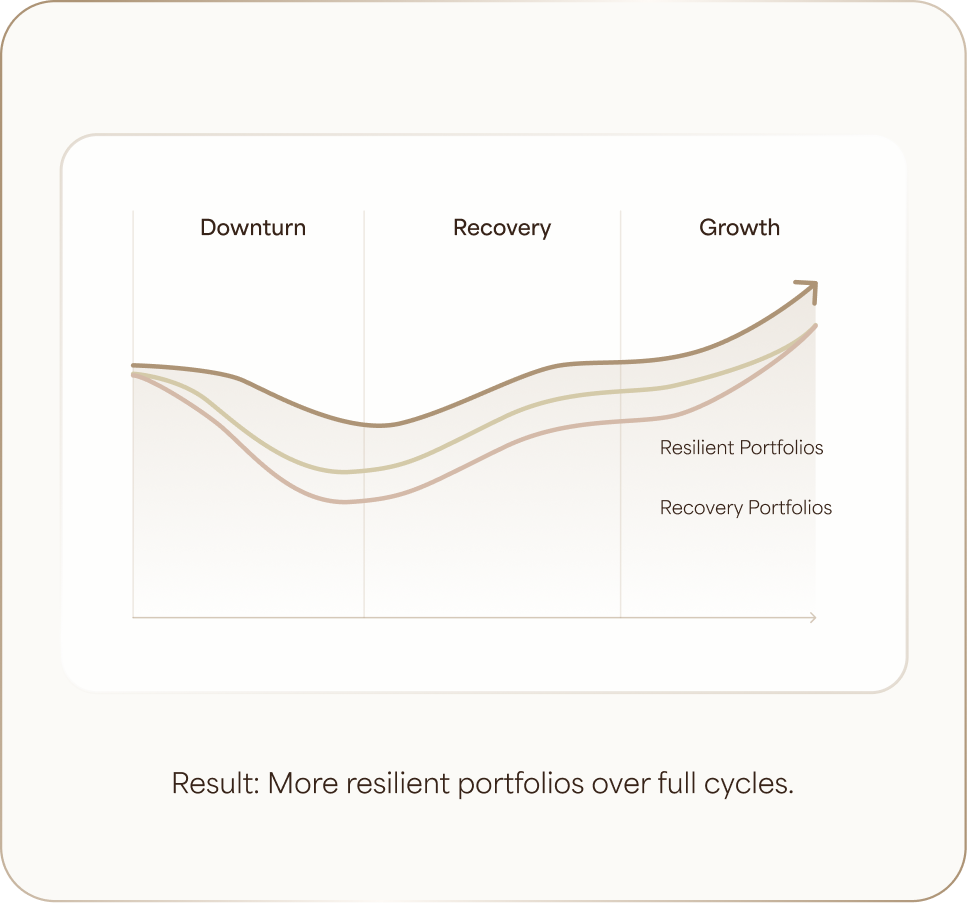

Resilience through Cycles

Preference for businesses with proven ability to withstand downturns while emerging stronger.

Meet The Family

- Advisory Committee

- Research Team

- Operations Team

- Founders

Jafar brings over a decade of global investing experience with a focus on emerging markets, especially India. As a Partner at Harding Loevner, he plays a key role in their Emerging Markets and International Equity strategies. Prior to joining in 2012, he worked at J.P. Morgan and Nomura in investment banking and equity research. Credentials: B.A. in Economics, M.A in Economics, Yale University | CFA Charterholder

Jafar Rizvi

Portfolio Manager – Harding Loevner

Gary has over 40 years of global experience in wealth and asset management. He has served as CIO and Managing Director at JPMorgan, Merrill Lynch, Barclays Wealth, Coutts, Emirates NBD, and FAB. Now leading The Global CIO, he advises institutional and private clients across macro strategy and multi-asset investing Expertise: Global macro strategy, multi-asset investing, wealth management

Gary Dugan

Founder – The Global CIO

With 25+ years of experience across global financial markets, Biswajit has held leadership roles in FX, fixed income, and equity investing. He was previously CIO at Emirates Investment Bank and held senior treasury roles at Invest AD and Al Khalij Commercial Bank. He played a pivotal role in setting up treasury and Islamic banking businesses in GCC. Credentials: Chartered Accountant (ICAI) | Alumnus of SRCC, Delhi University

Biswajit Dasgupta

Biswajit Dasgupta CIO – Asas Capital

Experience: 11+ years of experience (Buy-side & sell-side).He commenced his career with a buy-side firm in Chennai later on joined Mumbai based PMS firm. After that, he worked with the institutional equity desk. Education: Completed his MBA (Finance) from Chennai and Graduated from Delhi University.

Rakesh Roy

Head of Research

Experience: 5+ years of work experience. Worked with Deloitte in statutory audit post which she has worked with Westlife Development Limited (McDonald’s) in Financial planning and analysis, Education: Qualified Chartered Accountant (CA) and Chartered Financial Analyst CFA-L3 . Also an NISM certified Investment advisor (Level 1 & 2 cleared)

Trusha Faria

Research Analyst

Experience: 3+ years of work experience in the investment industry. He worked as a VC with a focus on agri-tech investments. Education: Graduated in B. Com. (Accounting and Finance) from Jai Hind College and CFA Level 3 cleared. Completed the Finplus program from Finacle Investment Academy.

Rikin Shah

Senior Research Analyst

Experience: 2+ years of experience in a equity market and has a firm grasp of industries including capital goods. Education: Graduated in B.com and cleared CFA (US) Level 2 in and has completed the Finplus program from Finacle investment Academy

Kenil Mehta

Senior Research Analyst

Experience: 3+ years of experience as a Senior Research Analyst in Omkara Capital since inception Education: Graduated in B.Com from Mithibai College , completed M.com and Finplus Program from Finacle Shah Classes

Shivam Parekh

Senior Research Analyst

Experience: 2+ years of work experience on the sell side handling a diverse portfolio of companies and also an ex-Citi Banker with experience in institutional credit research. Education: Completed MBA in Finance and Business Analytics and Graduated in Commerce.

Varun Gajaria

Research Analyst

Experience: 1+ year of work experience in standard chartered valuation team Education: Bachelors in engineering from Mumbai University PGDM in finance from Great Lakes Institute of Management, Chennai

Tanish Jhaveri

Research Analyst

Experience: 5+ years work experience in Financial and Equity Markets Education: Graduated in BMS from Sydenham College of Commerce and Economic. Certified with FinExpert from Finnacle Investment Academy.

Parth Gohil

Research Analyst

Experience: 5+ years of work experience as a Financial Data Analyst at Bahar Infocons Private Limited. Education: Graduated in B.Com and has cleared CFA (US) Level II. He has cleared FinPlus Program from Finacle Shah Classes

Aazeb Parbatani

Research Analyst

Experience: 2.5+ Years of work experience in compliance Shiv Hari Jalan & Co (Company Secretaries) Education: Graduated in Bachelor of Business Administration from JNVU University. Associate member of Institute of Company Secretary of India (ICSI), Pursuing LLB from Mumbai University.

Saloni Jain

Compliance Officer

Experience: 4+ years of work experience in sales & operations in the Finance industry. Education: Graduated in Bachelor in Financial markets from Mumbai University.

Ruchika Jain

Operations Manager

Experience: Operations professional with over 14 Years experience in Business process management. Team Management, Service quality and Re-engineering within Banking and Financial Services. Education: Bachelors of Commerce from Mumbai University

Jayant Chavan

Business Process Management

Experience: 11+ years of work experience as Assistant Manager in an operation Team in Asset Management at State Street Syntel Services Pvt Ltd and DANFA, Bajaj FinServ Ltd, Darshavi Facility Management, PAMAC FinServ Pvt Ltd and Abakkus Asset Manager LLP. Education: Graduated in B.com from GNVS Management College, NISM VI & VII Certified.

Vibhay Singh

Senior Manager Operations

Experience: 7+ years of experience in Accounts Education: Graduated in B.com

Pranay Bandre

Account Executive

Experience: 2+ years of work experience in Portfolio Management Services Firm. Education: Completed B.com & M.com

Asha Bhandari

Data Analyst

Over 18 years of work experience in equity research. Prior to Foundation of Omkara Capital, he was fund manager of a AMC and prior to this, Corporate Editor & Head of Research at CNBC — TV 18. He holds a degree in MSc Finance and MBA, Finance. VB has spent the last 15 years in Mumbai, learning from people across the spectrum, some of whom are his mentors

Varinder Bansal

Founder of Boring AMC

Himanshu has two decades of experience in Investment Research and Asset Management across asset classes. He has been with Asas since its inception managing proprietary equity investments and has executed numerous private equity transactions. He currently heads our Investment team focused on cutting edge value creation strategies.