Core Investment Philosophy

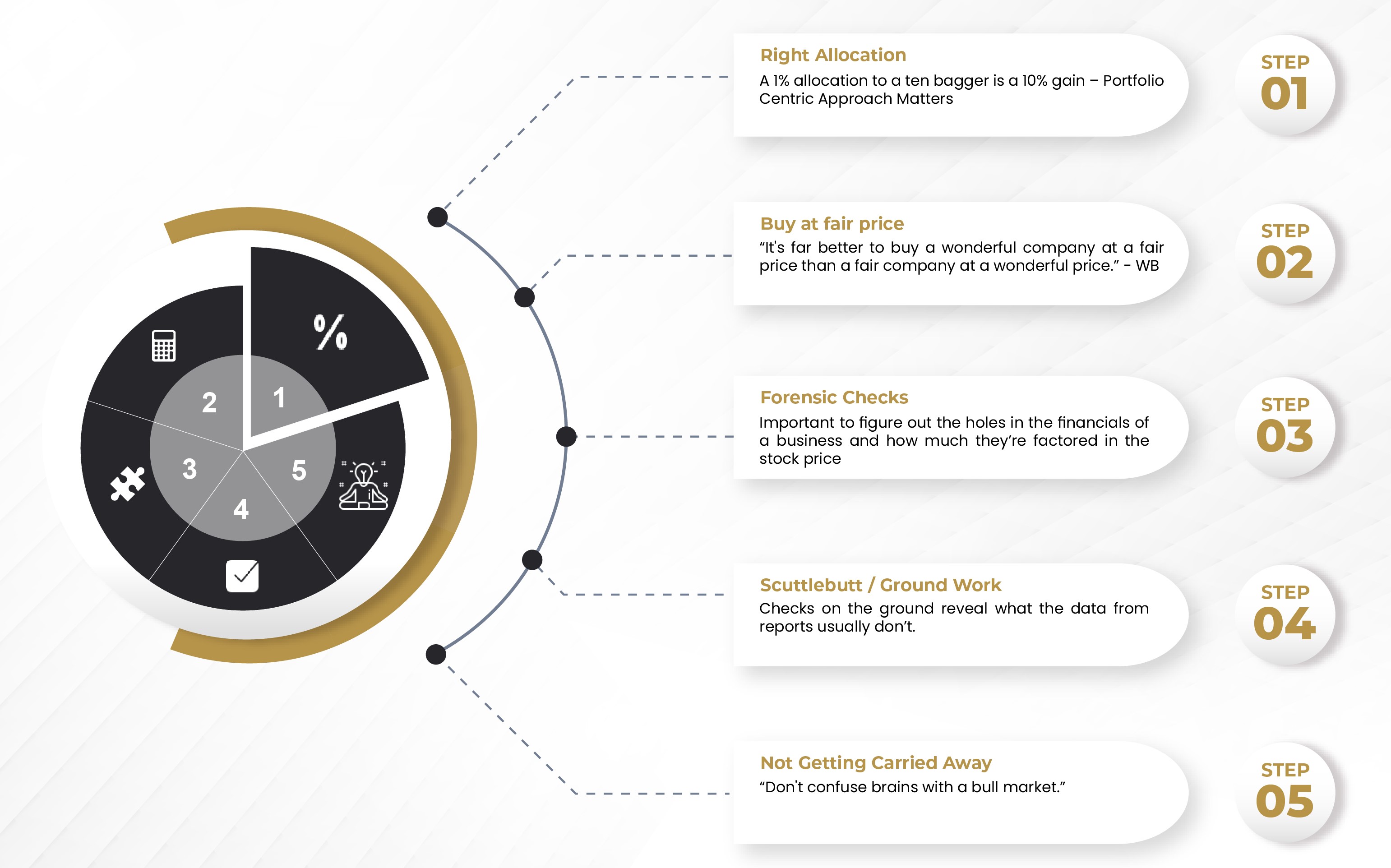

Most Important Things We Look For

- Big wealth is made if you catch the right business cycle & ride the winners. Important to track supply side, more than the demand side.

- We love businesses which operate on tight working capital which eventually drive ROCE and cash flows in the business. We want to invest in businesses where supply side is very difficult to create or even impossible. Businesses have unique technological, manufacturing excellence which cannot be replicated.

- We are neither a growth nor value investors but opportunistic investors. We go where the opportunity lies. We love to assess historical data of capital allocation & strategies adopted by the promoters.

- We don't believe in buy right and sit tight always. We will hold investments till thesis is working, and will be quick to exit if thesis changes at all