Our Vision

Our Vision

The Boring AMC is a vision of two dear friends: Mr. Varinder Bansal & Mr. Himanshu Khandelwal, who aspire to build the most honest, deep research focused & transparent asset management firm in India.

Our Leadership

Varinder Bansal

Founder of Boring AMC

Over 18 years of work experience in equity research. Prior to Foundation of Omkara Capital, he was fund manager of a AMC and prior to this, Corporate Editor & Head of Research at CNBC — TV 18. He holds a degree in MSc Finance and MBA, Finance. VB has spent the last 15 years in Mumbai, learning from people across the spectrum, some of whom are his mentors, and applying his strong fundamental skills and hard-nosed number crunching and analytical skills to identify investment ideas. His strength is years of experience in identifying not-so-fashion- able stock ideas. Most of these ideas have had a bedrock of strong fundamentals, superior balance sheets and boasted of high-quality promoters. He has coupled this approach with the strong feedback mechanism, which is effective due to his deep-root- ed connections with equity-market veterans and leaders of corporate India

Himanshu Khandelwal

Founder of Boring AMC

Himanshu has two decades of experience in Investment Research and Asset Management across asset classes. He has been with Asas since its inception managing proprietary equity investments and has executed numerous private equity transactions. He currently heads our Investment team focused on cutting edge value creation strategies. Prior to Asas Capital Ltd, Himanshu worked as a portfolio manager with a $400 million AUM at Kotak Securities, India’s largest financial services company. He is a CFA charter holder and holds a Master’s degree in Business Administration from IBS Hyderabad.

Unmatched Local And Global Investment Experience

Why The Boring AMC

Transparency

Communication

Controlling Mistakes

Skin-In-The-Game

Staying Humble And Connected

Why The Boring AMC

Transparency

Complete Access To Our Proprietary Data Room With Our Clients To Share Detailed Research Notes On Th...

Communication

Daily Updates On The Views On The Market, Any Imp Stock Market Information, And Earnings Eviews To H...

Controlling Mistakes

Our Focus Remains On “What Not To Do”. We Apply Forensic Analysis On Our Investment Ideas To Avoid A...

Skin-In-The-Game

We Invest Our Own Money With Our Clients In The Same Ideas.

Staying Humble And Connected

Money Is Made With Proper Data Backed Research And Staying Connected With Market Ecosystem. We Bring...

Track Record

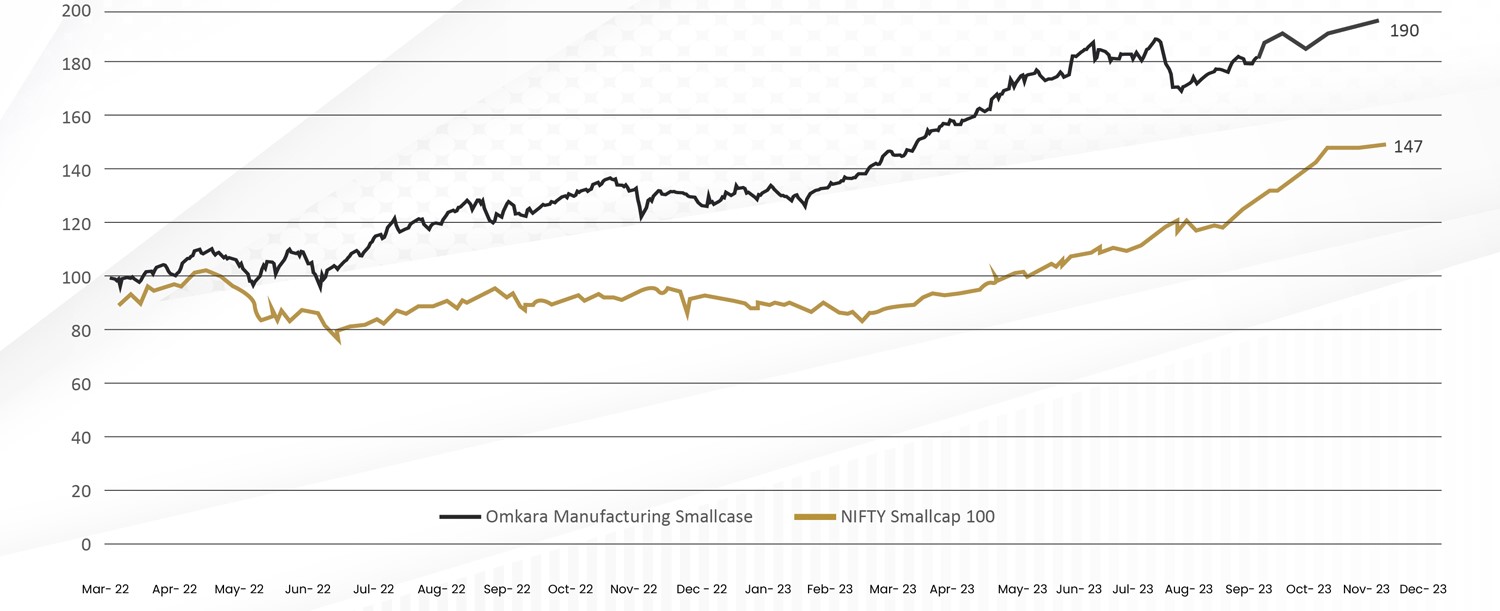

Past performance vs Equity Small-cap

| Omkara Manufacturing Smallcase Vs Nifty Smallcap 100 | Omkara Manufacturing | Equity Smallcap |

|---|---|---|

| 134% | 64% |

Omkara Manufacturing Smallcase Vs Nifty Smallcap 100

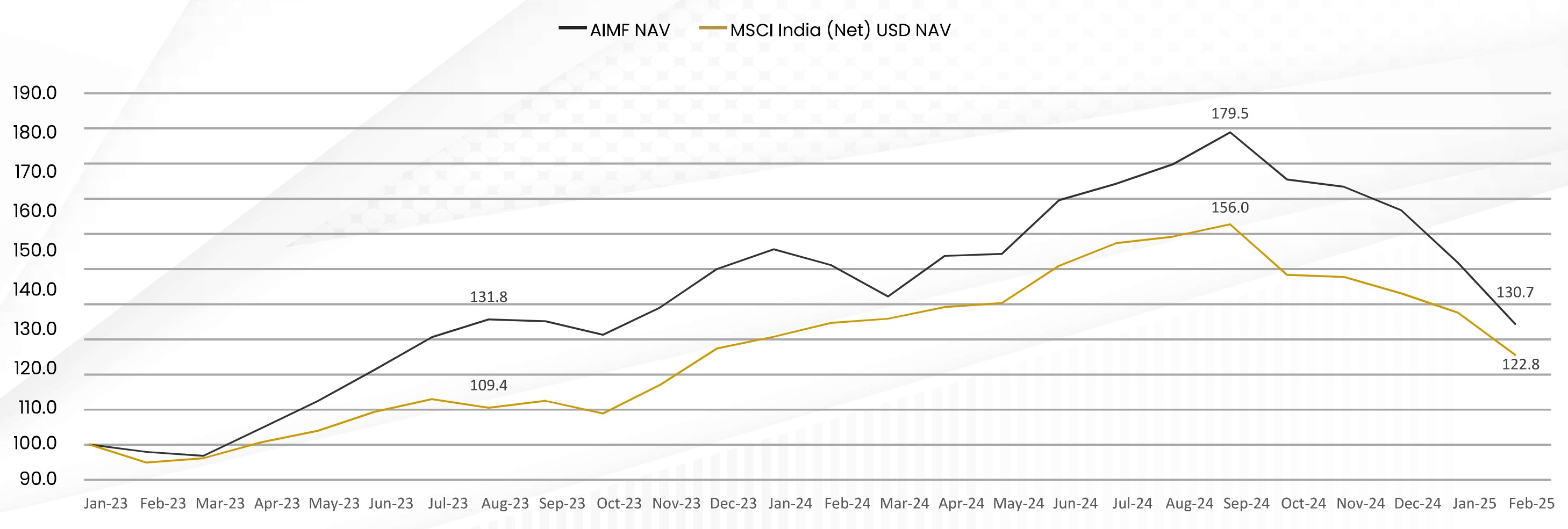

The Asas India Manufactruring Fund aims to generate capital appreciation for investors by investing in share of high growth companies within India's manufacturing sector

| Boring AIMF* | MSCI India USD (Benchmark) | AIMF Outperformance |

|---|---|---|

| 30.7% | 22.8% | 7.9% |

AIMF NAV

MSCI India (Net) USD NAV

Net return till date 30th september, 2023

The Boring AMC- © 2024 Design by JAVIN