In February 2023, we invested in Ami Organics at a price of ₹878 (Market Cap: ₹3,200 crores). Our

investmentthesis,thoughextensive,boileddowntothefollowing keypoints:

1. Promoter & Team: A technocratic promoter with strong scientific expertise, supported by a well-balanced team of youth and experience.

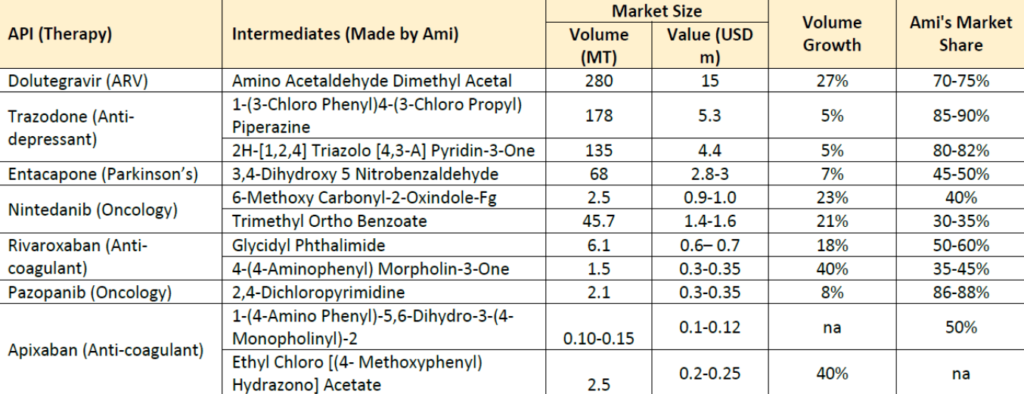

2. Strong Moats: A global leader, holding 30–90% global market share in complex pharma intermediates, with a solid track record. The company has been ahead of the curve, with a promising drug pipeline and potential opportunities driven by innovator-led New Chemical Entities (NCEs).

3. Forward-Looking Vision: Diversifying into the EV ancillary sector by venturing into electrolyte

production, alongside an entry into semiconductor chemicals (announced shortly after our entry)

through the acquisitionofBaba Fine Chemicals.

4. Growth Visibility: Strong growth prospects for at least the next decade at a relatively non-expensive

valuation,makingita lower-riskinvestmentfromourentrypoint.

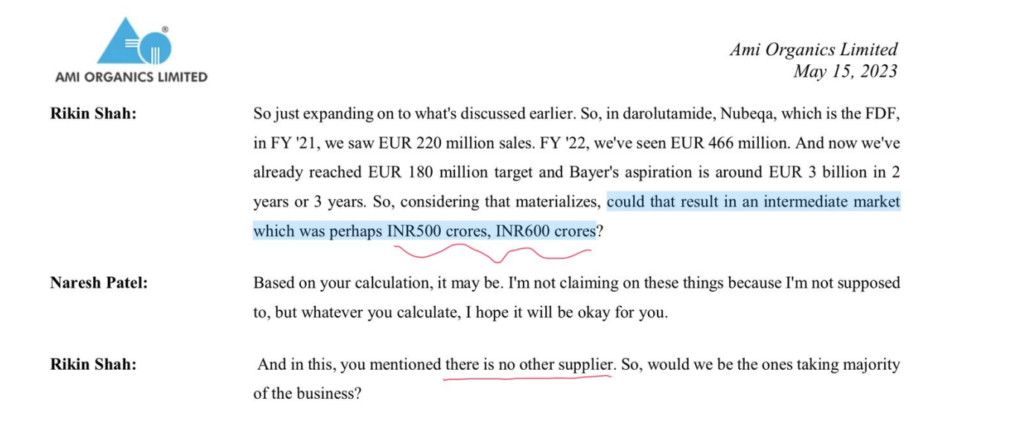

Beyond these factors our thesis anchored on the inflection point for Darolutamide – which is a

breakthrough molecule in the prostate cancer space (innovated by Orion – Ami’s existing client for

Entacapone). The molecule displayed hyper growth tendencies scaling from EUR 220 Mn to >460

Mn+ in 2022 – with guidance of >3Bn EUR by 2030. We anticipated this opportunity to be larger

than Acutaas’s topline in FY23 (Rs 617 Cr).

When we invested in the company, there was almost no neutral institutional coverage on the business – just plain noise that kept away good brokerages.

Our investment in Ami Organics was far more contrarian than expected. Throughout the holding period,

we encountered persistent skepticism from our team, clients, and the analyst community. Even marquee investors with ownership from the Pre-IPO round (anchor book) seemed to have lost confidence.

Some of the key counter arguments we faced were:

- “The promoter is all talk”: There were concerns due to repeated missed guidance.

- “The electrolyte opportunity is a sham”: Delays in this segment fueled doubts about its potential.

- Post-Ǫ2 FY24 earnings:A significant dip in performance led to the beliefthatmargins would not

recover. - Bearish reports: One prominent sell-side analyst frequently released downgrade reports,

forecasting doomsday scenarios(althoughtheywereentitledtotheir views).

A downgrade by a particular SELL SIDE Analyst had the target price listed below Rs 700/share. - Valuations: Concerns that the Price-to-Earnings (P/E) ratio was unsustainable,

questioninghowreturns couldbegenerated.

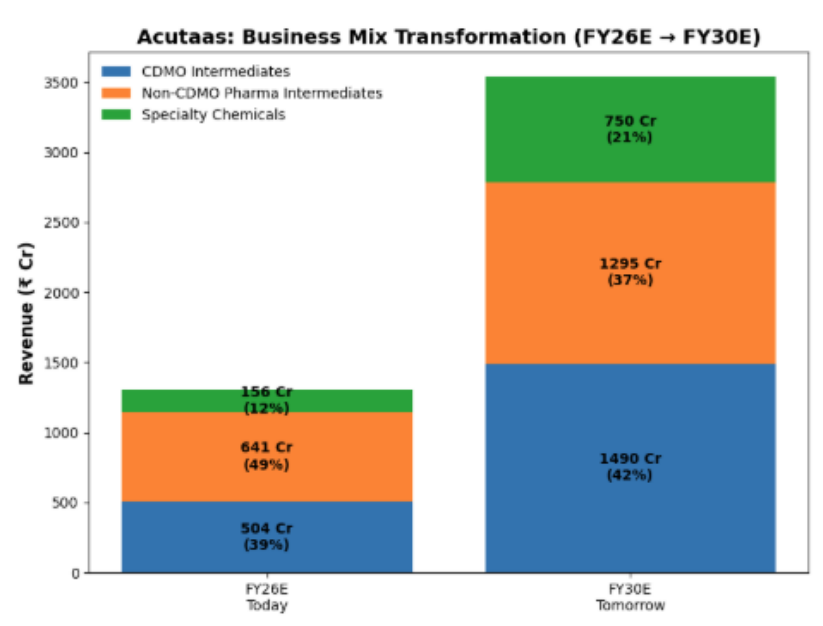

The Road Ahead – Transformation to a multi segment giant

Acutaas’s transformation to a multi-segment giant is based on seeds sown over several years/decades.

Despite the skepticism and noise, the experience with Ami Organics provided valuable lessons:

Avoid Being a P/E Investor: Don’t base your decisionssolely on P/E ratios. A wise man once said on

selling stocks basedonvaluations –“Don’t be lazy,be very lazy”.

While several stocks have performed even better for us over a similar timeframe, I take great pride in the

journey with AMI.

Prices Shape Narratives: Today, institutions such as HDFC, SBI

and Marcellus are significant investors in the same business that was once criticized for

having a promoter who was perceived as “ALL TALK.” Large brokerages have now initiated

coverage (Kotak), and others have acknowledged vast opportunities in the electrolyte space

(Spark/JM).

Patience is Key: It’s challenging to watch other stocks soar while your position lags. But don’t let

short-term price movements cloud your judgment. If your investment thesis holds true, your

day will come.

Market EǪ > IǪ: While buying a stockmay be easy,sizing and scaling your position is much

harder. The world will try to push you out of your position – if you let it. Ignore the noise and havethe

stomachtopowerthrough.

Good News and Good Prices seldom coincide: When optionality’s seemed uncertain, and

executionseemed weak,the stockprice was also onthe lowerside.